FLATLANDS — The Rent Guidelines Board, the agency that regulates rent-stabilized housing in New York City, is poised to vote on the biggest rate hike requests in nearly 10 years, giving renters and affordable housing advocates cause for alarm.

A final vote is scheduled for June 21. But earlier in May, a preliminary vote by the board called for a boost in one-year leases by 2-4%. Also, two-year lease rates could grow 4-6%. The last time rates were allowed to go this high was in 2013 when one-year leases jumped 4%, while two-year leases grew by 7.5%.

Landlord groups say higher rates in rent-stabilized housing are needed to help them stay in business due to soaring costs brought on by rising inflation.

For example, the current annual inflation rate in the U.S. is 8.3% for the 12 months that ended April 2022, according to the U.S. Labor Department data published May 11. This federal agency’s data also shows that annual inflation was 1.7% a decade ago.

But one Brooklyn woman said inflation hurts everyone, particularly people on fixed incomes still struggling to recover from the COVID-19 pandemic.

“Everything else is going up, but not our salaries,” said Beverly Johnson, who lives on East 46th Street in the Flatlands neighborhood in southeast Brooklyn.

Johnson, a native of Trinidad and Tobago, has lived here for 20 years. She works in a group home and is a member of St. Thomas Aquinas Parish, also in the Flatlands.

“We are paying 50% more in groceries,” she added, “and don’t even start talking about gasoline prices.”

New York City adopted rent stabilization in the late 1960s to help ensure the availability of affordable housing in one of the most expensive cities on the planet.

About 1 million homes, approximately half the city’s rental units, are rent-stabilized.

The preliminary vote, which passed 5-4, was held during the May 5 meeting of the board. The proposed rate increases are less than what was asked for by two landlord representatives on the board, and more than what was sought by the two tenant representatives.

Robert Ehrlich, one of the board’s landlord representatives, argued for higher rates.

“Inflation,” he said prior to the vote, “is hurting property owners as the cost of providing safe, clean, affordable housing continues to rise.”

Ehrlich pointed to board research that shows about one-third of rent-stabilized buildings are spending more than 70% of their operating income on these costs.

“These buildings are functionally bankrupt,” Ehrlich said. “All indications are that these buildings are in a downward trend towards insolvency unless the board approves increases that keep up with the costs.”

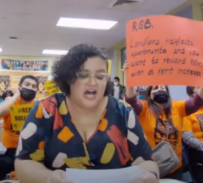

Arguing for tenants is Communities Resist, a legal services non-profit group.

“We know what’s coming down the pike,” said Lina Lee, the group’s executive director.

Lee, a lawyer, said the temporary moratoriums during the pandemic paused eviction proceedings, but those protections expired earlier this year. The city’s housing courts are now flooded with new or renewed eviction cases.

Tenants are entitled to legal representation, Lee said, but many don’t know how to apply for the help. She added that others are undocumented workers who fear attention from immigration officers if they fight evictions in court.

“This will really lead to increased housing court cases, evictions, and homelessness,” Lee said.

Consequently, she noted, longtime residents, many reflecting the city’s prized cultural diversity, could be forced to leave the neighborhoods where they’ve lived their entire lives.

Meanwhile, a controversial affordable housing program is expected to expire this month without sufficient backing in the Democrat-controlled Legislature to keep it going or overhaul it.

The 421-a law began in 1971 to incentivize developers with tax breaks if they created rent-stabilized apartments in new buildings.

Proponents say the law helped create hundreds of thousands of affordable apartments that are still rent-stabilized. But according to Lee, “The lack of enforcement and monitoring of these 421-a buildings has always been a problem.”

She explained that qualifying for the tax exemption also involves following strict building standards for construction and occupancy.

“For a lot of these landlords, they did not construct the building correctly, and they don’t really invest in making sure that it’s habitable,” Lee said. “Then, on the state level, you don’t have the proper inspection being done.”

Mayor Eric Adams, who took office on Jan. 1, has pledged to overhaul the city’s affordable-housing programs to inject more affordability and timely availability, as well as help reverse homelessness.

On May 26, Adams joined Gov. Hochul in announcing the start of construction on a $100 million affordable and supportive housing development in Far Rockaway. The 17-story building, with 194 apartments, is the first phase of an 11-phase master redevelopment at the former Peninsula Hospital Center site. The mixed-use community will eventually offer more than 2,000 affordable homes, retail, community space, medical facilities, and outdoor public space.

Gov. Hochul called the project “a transformative development that will improve the lives of residents and strengthen the entire Far Rockaway community.” It is part of the governor’s $25 billion, five-year plan that is expected to increase inventory by creating or preserving 100,000 affordable homes.